Introduction

Tax-Saving Tips for Salaried Individuals can make a significant difference when navigating the complexities of tax planning. With frequent changes in rules and regulations, it’s easy to feel overwhelmed. However, by understanding and applying the right strategies, you can effectively reduce your tax liability and improve your overall financial efficiency.

This guide highlights the most effective tax saving tips for salaried individuals in 2025. From smart investment options to optimized use of deductions and exemptions, these practical strategies are designed to help you make the most of your income while staying compliant with current tax laws.

Why Tax Planning Matters in 2025

Tax planning is more than just saving money — it’s about maximizing your income while staying compliant with legal tax regulations. Effective tax planning strategies ensure you can achieve your financial goals, avoid last-minute panic, and improve your net take-home salary. In 2025, as the government introduces refined tax brackets and exemptions, it becomes even more essential to stay updated and proactive.

Top Tax Saving Tips for Salaried Individuals

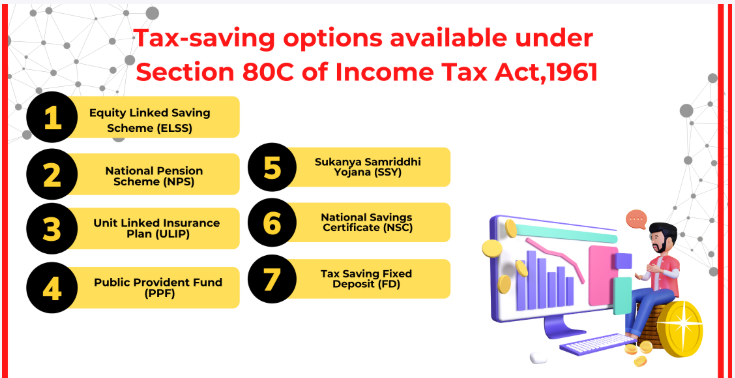

1. Utilize Section 80C to the Fullest

One of the most popular tax saving tips, Section 80C of the Income Tax Act allows deductions up to ₹1.5 lakh annually. You can invest in:

- Public Provident Fund (PPF)

- Employee Provident Fund (EPF)

- National Savings Certificates (NSC)

- Life Insurance Premiums

- Tax-saving Fixed Deposits

Maximizing this section is a core part of most tax planning strategies.

2. Invest in National Pension Scheme (NPS)

Under Section 80CCD(1B), you can claim an additional ₹50,000 deduction by investing in NPS, over and above the 80C limit. This not only helps with tax saving but also ensures long-term retirement planning, a vital element of any smart investment portfolio.

3. Claim HRA (House Rent Allowance)

If you live in rented accommodation, HRA can offer a significant tax break. Salaried employees can claim HRA exemptions based on actual rent paid, salary structure, and city of residence. Be sure to keep rent receipts and rental agreements as proof.

4. Take Advantage of Home Loan Benefits

Home loans offer tax benefits on both principal and interest components:

- Section 80C: Principal repayment up to ₹1.5 lakh

- Section 24(b): Interest up to ₹2 lakh annually

Owning a home not only offers financial security but also aligns well with long-term tax planning strategies.

5. Use Section 80D for Health Insurance

Medical expenses can be unpredictable. By purchasing health insurance, you not only protect your family but also save on taxes. Section 80D offers:

- ₹25,000 deduction for self and family

- ₹50,000 additional for senior citizen parents

It’s one of the most overlooked yet effective tax saving tips for salaried individuals.

6. Education Loan Interest Deduction (Section 80E)

If you’re repaying an education loan, interest paid can be claimed as a deduction under Section 80E for up to 8 years. There’s no cap on the amount, making it a valuable tip for those enhancing skills through higher education.

7. Leave Travel Allowance (LTA)

LTA allows you to claim exemption for travel expenses within India. You can claim it twice in a block of four years. Make sure to retain travel bills, tickets, and invoices.

8. Standard Deduction

The standard deduction of ₹50,000 continues in 2025 for salaried individuals. It’s an automatic deduction that reduces your taxable income without needing proof or documentation.

Bonus Tips for Better Tax Planning

- File your income tax returns early to avoid errors.

- Maintain proper documentation for all investments and expenses.

- Consider hiring a financial advisor to tailor tax planning strategies to your specific situation.

- Stay informed about new government schemes and amendments.

Conclusion

Efficient tax management is essential for maximizing income and securing your financial future. With the right Tax-Saving Tips for Salaried Individuals, you can reduce liabilities and boost savings. In 2025, implementing effective Tax-Saving Tips for Salaried Individuals ensures smarter financial decisions. These Tax-Saving Tips for Salaried Individuals help you take control of your money and plan better. By staying informed and proactive with Tax-Saving Tips for Salaried Individuals, you pave the way for long-term financial peace and stability.