Capital gains tax is a vital part of personal finance that many investors in India tend to overlook. Whether you’re selling real estate, mutual funds, or stocks, understanding how capital gains tax in India works can help you save a substantial amount. This guide simplifies the concepts of short-term and long-term capital gains with practical examples to enhance your understanding. Knowing the differences between these can help you make informed investment decisions and avoid unexpected tax burdens. We also explore effective tax planning strategies to legally reduce your liabilities and retain more of your earnings.

What is Capital Gains Tax in India?

Capital gains tax in India is imposed on the profit earned from selling a capital asset. These assets can include real estate, stocks, mutual funds, gold, and other investments. The tax is triggered only when the asset is sold, not while it is being held. Depending on how long the asset is held before sale, the gains are categorized as either short-term or long-term, each with different tax rates and exemptions. Understanding the nature of the asset and the applicable holding period is crucial for accurate tax planning and compliance.

The gains are categorized into:

- Short-Term Capital Gains (STCG)

- Long-Term Capital Gains (LTCG)

Each is taxed differently depending on the type of asset and holding period.

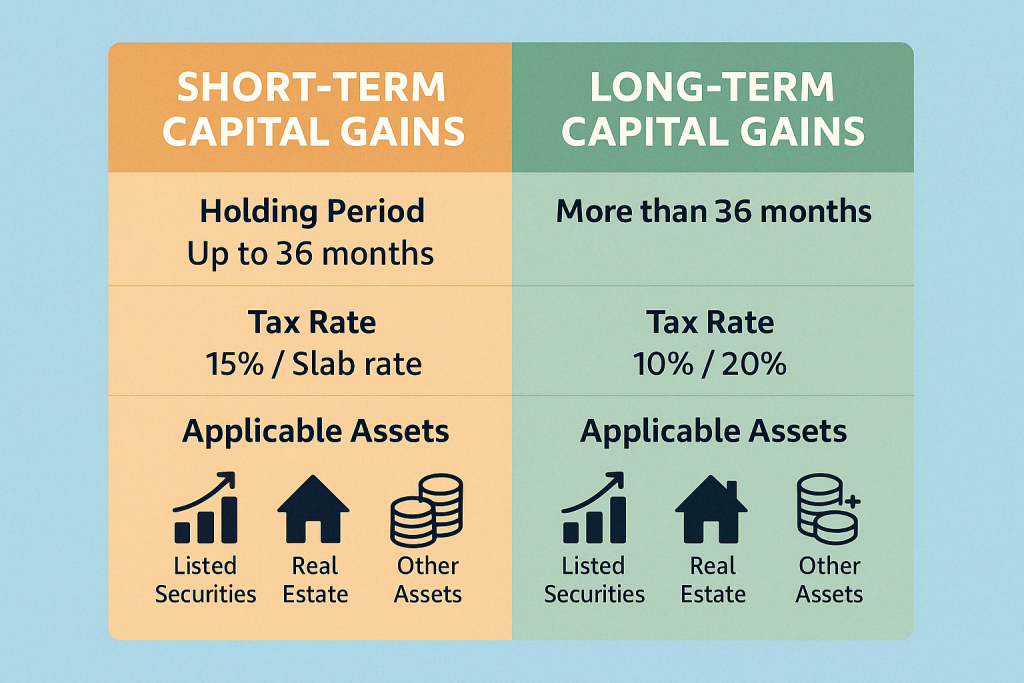

Short-Term vs Long-Term Capital Gains

📌 Short-Term Capital Gains (STCG)

- Definition: Assets sold within 36 months of purchase (12 months in the case of listed securities).

- Tax Rate:

- Listed equities: 15%

- Other assets: Taxed as per individual’s income tax slab

- Example: Selling stocks after 6 months of purchase results in a 15% tax on the profits.

📌 Long-Term Capital Gains (LTCG)

- Definition: Assets held for more than 36 months (12 months for equities and mutual funds).

- Tax Rate:

- Equities & Mutual Funds: 10% (above ₹1 lakh annual gain, without indexation)

- Other assets: 20% (with indexation benefit)

- Example: Selling a flat after 4 years will attract 20% tax on indexed gains.

Importance of Capital Gains Tax in Financial Planning

The importance of capital gains tax in financial planning cannot be overlooked, especially for those aiming to build long-term wealth. Capital gains tax impacts the profits earned from selling assets like property, stocks, or mutual funds. Understanding how it works helps investors make smarter investment decisions and avoid surprise tax liabilities. By factoring in these taxes, you can time your asset sales better and optimize your returns. Including capital gains tax in your financial plan ensures improved tax efficiency and stronger cash flow management. A tax-aware investment strategy is key to maximizing returns and achieving financial stability.

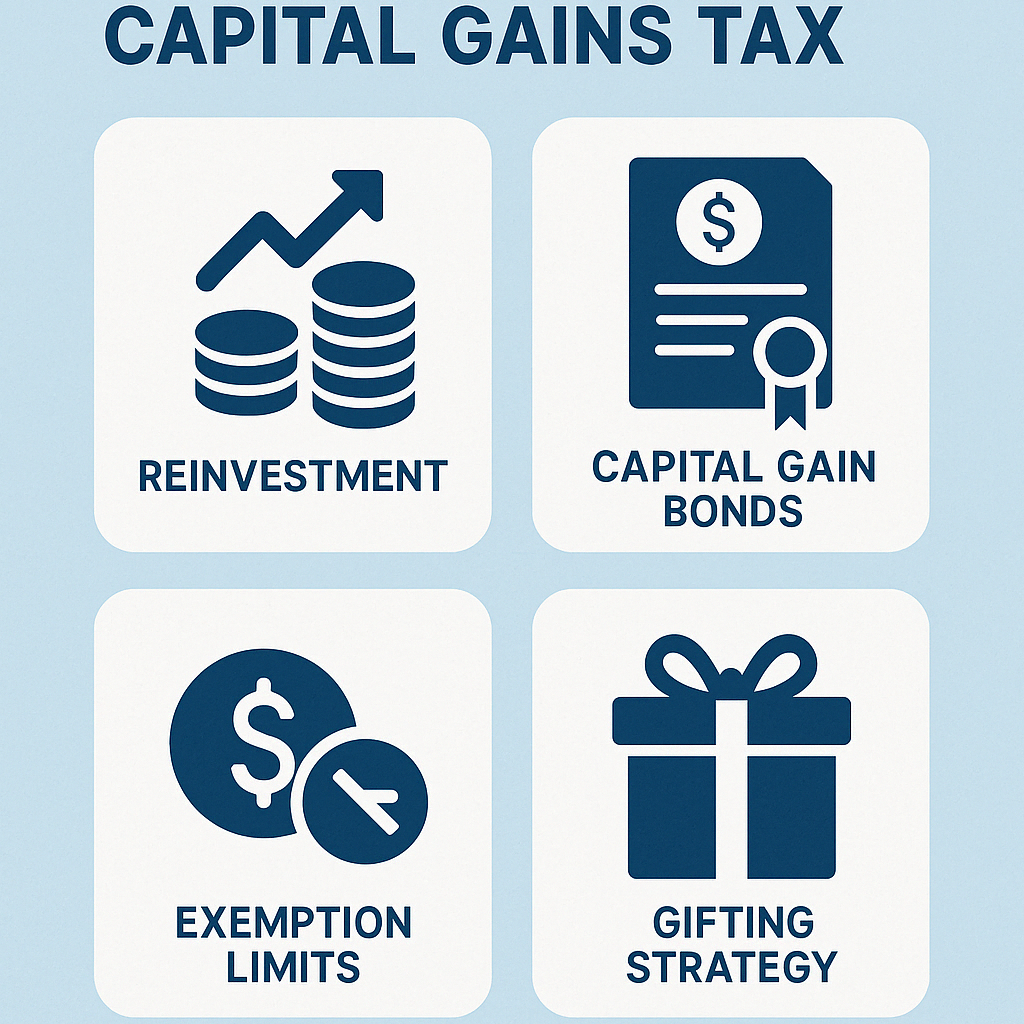

Smart Tax Planning Strategies for Capital Gains

🔸 1. Use the Basic Exemption Limit

If your total income including capital gains is below the exemption limit (₹2.5 lakh for individuals), you may not have to pay tax on capital gains at all.

🔸 2. Invest in Capital Gain Bonds (Section 54EC)

You can save tax on LTCG from the sale of property by investing up to ₹50 lakh in bonds issued by NHAI or REC.

🔸 3. Reinvest Under Section 54 or 54F

Selling a residential property? Reinvesting in another property within 2 years (or constructing within 3 years) can exempt your capital gains.

🔸 4. Harvest Losses

Use short-term capital losses to offset short-term gains, and long-term losses to offset long-term gains to lower your tax burden.

🔸 5. Gift Assets Strategically

Transferring assets to family members in a lower tax bracket can help in reducing overall tax liability.

These Tax Planning Strategies can significantly reduce your tax outgo and help grow your wealth efficiently.

Common Mistakes to Avoid

- Not considering indexation benefits for LTCG.

- Selling within a short-term period just to book profit, triggering higher taxes.

- Ignoring carry-forward loss provisions.

- Misreporting or forgetting capital gains in ITR.

Final Thoughts

Mastering capital gains tax in India isn’t just for tax experts—it’s essential for every smart investor. With the right knowledge and a bit of planning, you can significantly reduce your tax burden and make more informed investment decisions. Whether you’re dealing with property, stocks, or mutual funds, understanding how capital gains are taxed helps you legally save money and optimize returns. Tax laws can be complex and ever-changing, so it’s wise to stay updated and proactive. Most importantly, always consult a qualified tax advisor to create personalized tax planning strategies tailored to your unique financial goals and situation.

Remember, it’s not just about earning more—it’s about keeping more of what you earn.