TDS (Tax Deducted at Source) is a key component of India’s income tax system. TDS in India plays a crucial role in the country’s income tax framework. It enables the government to collect taxes directly at the source of income, ensuring regular revenue and reducing tax evasion. Whether you’re a salaried employee, a freelancer, or a business owner, understanding how TDS in India works is essential—not just for legal compliance, but also for smart and efficient tax planning.

In this guide, we’ll explore what TDS is, the TDS rates for 2025, and how to claim TDS refunds, including the role of Form 26AS.

What is TDS?

TDS stands for Tax Deducted at Source. It is a system where the payer deducts tax before making a payment and remits it directly to the government on behalf of the payee.

Common examples where TDS applies:

- Salaries

- Interest on fixed deposits

- Rent payments

- Contractor payments

- Commission and brokerage

This method minimizes tax evasion and ensures consistent tax collection.

TDS Rates 2025 in india: What You Should Know

TDS rates differ based on the type of income and the status of the recipient (individual, HUF, company, etc.). Here’s an overview of updated TDS rates 2025 for common payments:

### Salaries

- TDS is deducted as per income tax slab rates applicable after considering deductions and exemptions.

### Fixed Deposits (FDs)

- 10% if PAN is furnished

- 20% if PAN is not provided

### Rent

- 10% for rent of land/building exceeding ₹2.4 lakhs/year

- 2% for rent on plant/machinery exceeding the same threshold

### Professional Fees (Section 194J)

- 10% for most professional services

- 2% for technical services

### Contractor Payments (Section 194C)

- 1% for individuals/HUF

- 2% for others

For a full list of TDS rates 2025, refer to the Income Tax Department’s official circulars or speak to a tax advisor to check what applies to you.

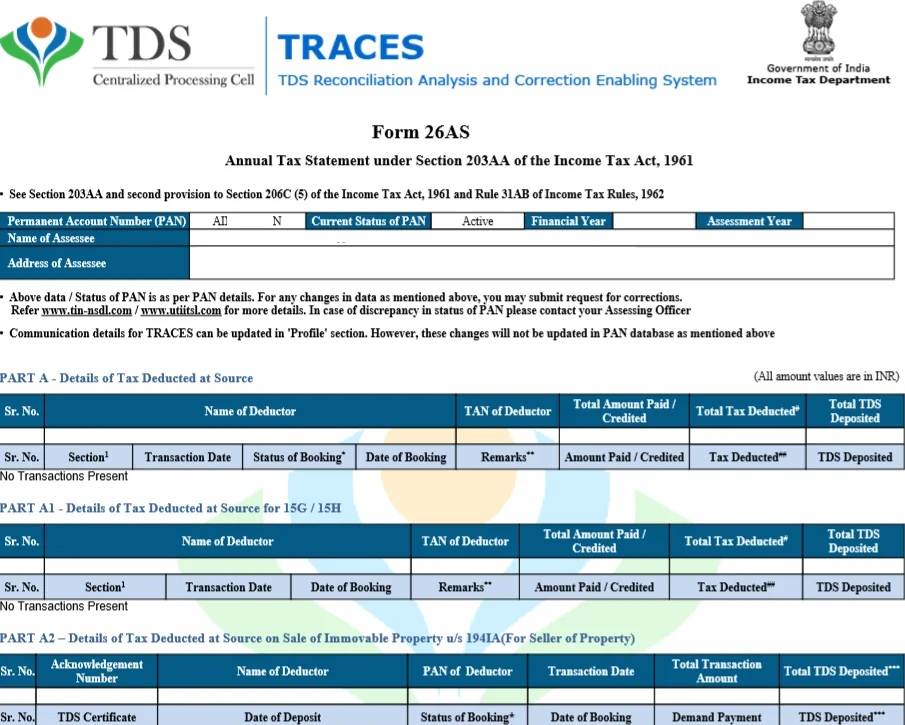

What is Form 26AS and Why Is It Important?

Form 26AS is a consolidated annual tax statement that includes:

- Details of TDS deducted by various entities

- Advance tax/self-assessment tax payments

- High-value transactions like property purchases

Before filing your income tax return, always check your Form 26AS to confirm that all TDS amounts are correctly credited to your PAN.

You can view it on the TRACES portal or through your net banking account if linked with your PAN.

Understanding the TDS Refund Process in india

Sometimes, the total TDS deducted during the year may exceed your actual tax liability. This commonly happens when:

- You fall in a lower tax slab

- You forgot to submit investment proofs

- You had multiple income sources and overpaid tax

In such cases, you are eligible for a TDS refund.

### How to Claim a TDS Refund:

- File Your Income Tax Return (ITR):

Mention all your income and TDS details using the data in Form 26AS. - Match TDS in Form 26AS:

Ensure all TDS entries match the figures shown in your form. - Choose Correct Bank Details:

Enter a valid bank account and IFSC code in your ITR form for direct credit of the TDS refund. - E-Verify Your Return:

Your refund process starts only after successful e-verification. - Track the Status:

Use the Income Tax e-filing portal to track your TDS refund process.

The TDS refund process usually takes 4–6 weeks, but it could be longer during peak filing seasons.

Pro Tips to Manage TDS Efficiently

- Submit Form 15G/15H if your income is below the taxable limit to avoid TDS on FDs.

- Track TDS in real-time via the AIS (Annual Information Statement) introduced recently.

- File returns on time to speed up the TDS refund process and avoid penalties.

- Keep your PAN updated with all deductors to prevent excess deduction.

Understanding the key aspects of TDS in India—from applicable rates to deductions across different income types—is essential for every taxpayer. With changing regulations and thresholds, staying updated on the latest rules around TDS in India can help avoid unnecessary deductions or missed refund opportunities. Whether you’re salaried, self-employed, or managing a business, keeping track of your TDS credits through Form 26AS ensures smoother ITR filing. By gaining clarity on how TDS in India works, you can take control of your tax planning and make informed financial decisions before the year ends.

Final Thoughts

Understanding TDS rates 2025, how they apply to different incomes, and staying aware of your Form 26AS can save you from tax troubles and help recover excess taxes via the TDS refund process. Whether you’re a first-time taxpayer or a business owner managing employee payroll, staying TDS-compliant is both a legal necessity and a smart financial move.