The old vs new tax regime in India debate is more relevant than ever as we step into FY 2025–26. Choosing the right tax structure can significantly impact your financial planning and savings. With both options still available in India, many salaried individuals and professionals are left wondering: which tax regime is better? To make an informed decision, it’s essential to understand the pros and cons of each regime under the old v/s new tax regime 2025 comparison.

In this article, we’ll break down the major differences between the old and new tax regimes in India, who benefits from which, and help you decide which tax regime is better for your income and goals.

What is the Old vs New Tax Regime?

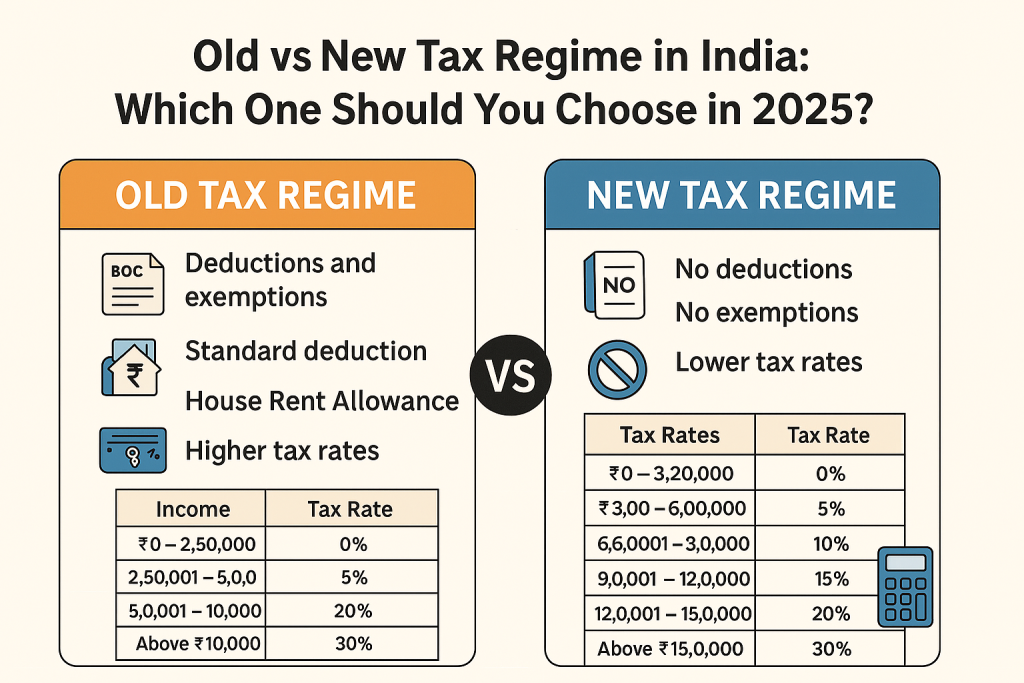

The old tax regime allows taxpayers to claim a wide range of deductions and exemptions under various sections of the Income Tax Act, including:

- Section 80C: Up to ₹1.5 lakh for investments like PPF, ELSS, LIC, and more

- Section 80D: Premiums paid for health insurance

- House Rent Allowance (HRA)

- Standard Deduction: ₹50,000 for salaried individuals

- Home Loan Interest under Section 24(b)

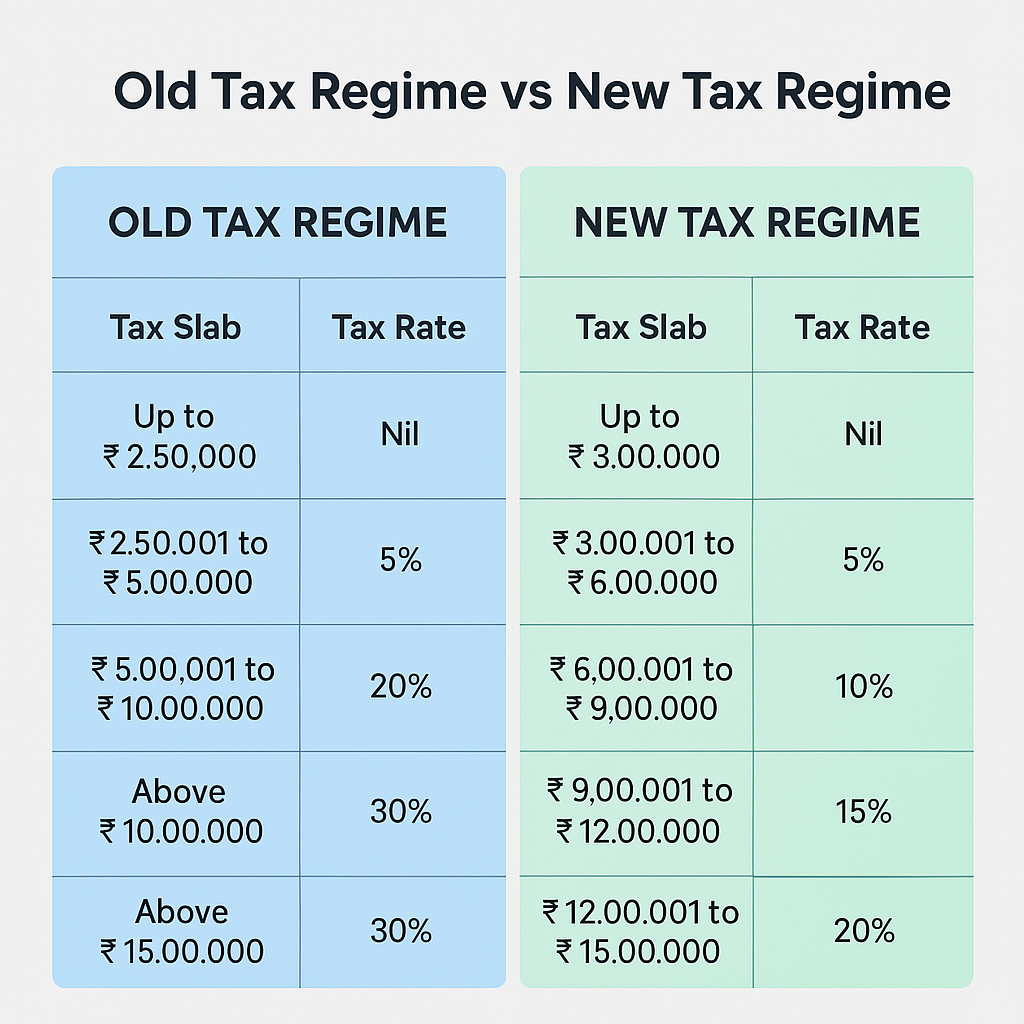

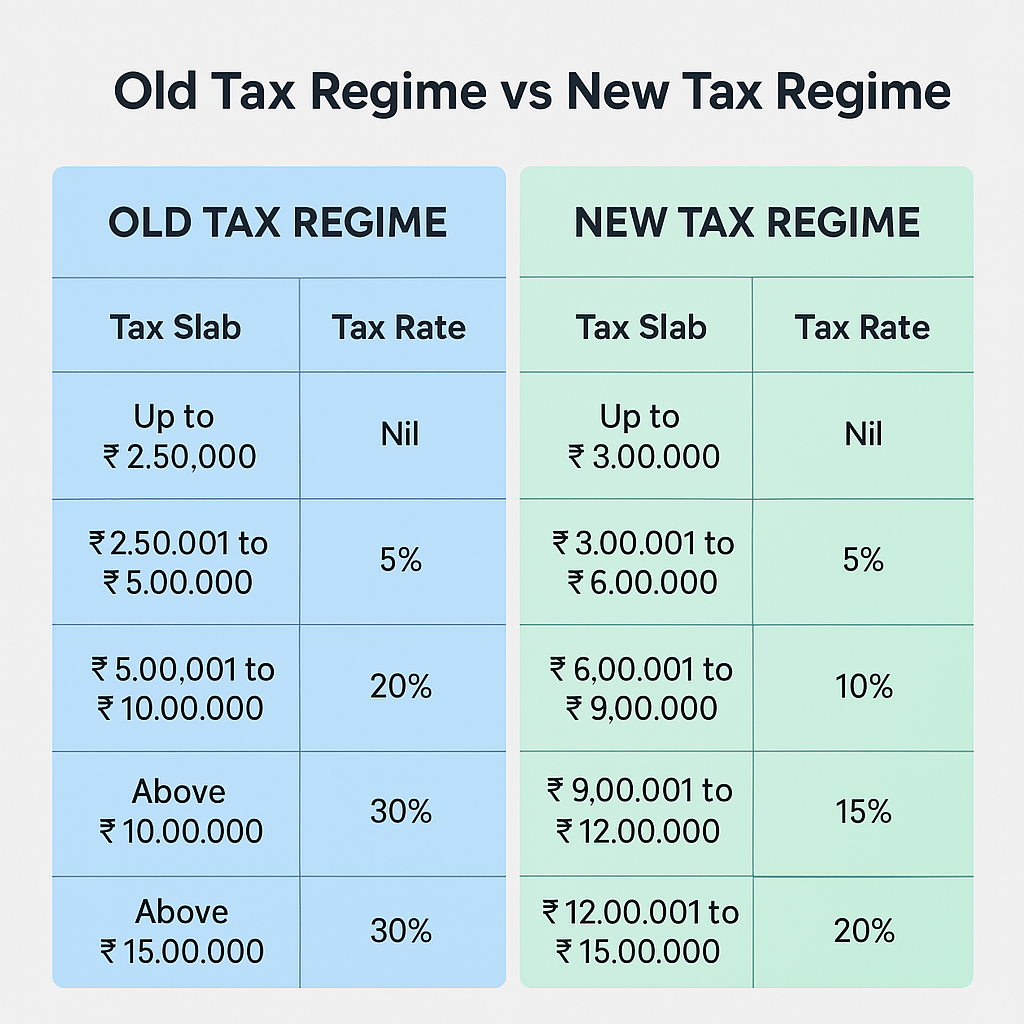

Under the old regime, income is taxed at the following slabs for individuals below 60 years of age:

| Income Slab | Tax Rate |

|---|---|

| Up to ₹2.5 lakh | Nil |

| ₹2.5 lakh – ₹5 lakh | 5% |

| ₹5 lakh – ₹10 lakh | 20% |

| Above ₹10 lakh | 30% |

If you have significant tax-saving investments and deductions, this regime is often the better option.

What is the New Tax Regime?

The new tax regime, introduced in FY 2020-21, comes with lower tax rates but without most deductions and exemptions. Here’s the current slab structure under the new tax regime for FY 2025–26:

| Income Slab | Tax Rate |

|---|---|

| Up to ₹3 lakh | Nil |

| ₹3 lakh – ₹6 lakh | 5% |

| ₹6 lakh – ₹9 lakh | 10% |

| ₹9 lakh – ₹12 lakh | 15% |

| ₹12 lakh – ₹15 lakh | 20% |

| Above ₹15 lakh | 30% |

Although deductions like 80C or HRA aren’t available here, the new regime offers simplicity and lower rates—especially beneficial for individuals who don’t invest much in tax-saving instruments.

Key Differences Between Old and New Regimes

1. Deductions and Exemptions

- Old Regime: Allows over 70 exemptions and deductions.

- New Regime: Offers very limited deductions (like NPS for employer contributions).

2. Tax Filing Complexity

- Old Regime: More paperwork and planning involved.

- New Regime: Straightforward and hassle-free.

3. Best Suited For

- Old Regime: Those with home loans, insurance, PPF, ELSS, and other tax-saving instruments.

- New Regime: Salaried individuals with fewer deductions or those who prefer simplicity.

Which Tax Regime Is Better for You in 2025?

This brings us to the central question: which tax regime is better?

The answer depends on your income level, lifestyle, and ability to claim deductions. Let’s look at a few examples:

Example 1: Low Deductions

- Income: ₹10 lakh

- Deductions: None

- Better Option: New regime

Example 2: High Deductions

- Income: ₹12 lakh

- Deductions: ₹3 lakh (80C, 80D, HRA)

- Better Option: Old regime

If you’re able to claim deductions over ₹2.5 lakh, the old tax regime is likely to be more beneficial. If not, the lower rates in the new regime might save you more.

Tools to Help You Decide

To calculate which tax regime is better in your case, you can use:

- Government-approved online tax calculators

- A CA or tax advisor for detailed comparisons

- DIY spreadsheets for quick personal calculations

Final Verdict: Which Tax Regime Is Better in 2025?

The choice between the old and new tax regimes isn’t about which is universally better—it’s about which tax regime is better for you.

Choose the old tax regime if:

- You invest in 80C options like PPF or ELSS

- You pay home loan interest

- You claim HRA, LTA, and other exemptions

Go with the new tax regime if:

- You don’t use many deductions

- You prefer simplicity and minimal paperwork

- You’re a freelancer, consultant, or early-career professional

In summary, when trying to decide which tax regime is better, the answer lies in your personal financial habits and goals. Review your yearly investments and deductions, calculate your potential tax liability under both regimes, and make an informed decision. The right choice can help you save thousands in taxes while aligning with your financial plans for the future.

When it comes to choosing between the Old vs New Tax Regime, understanding the differences is crucial for effective financial planning. The Old vs New Tax Regime debate centers on deductions and exemptions. The old regime allows taxpayers to claim various deductions under sections like 80C, 80D, and HRA, making it suitable for those with investments and expenses. The new regime offers lower tax rates but removes most exemptions. Salaried individuals and professionals should calculate their taxable income under both to see which works best. Choosing wisely can lead to significant tax savings and better financial outcomes each year.